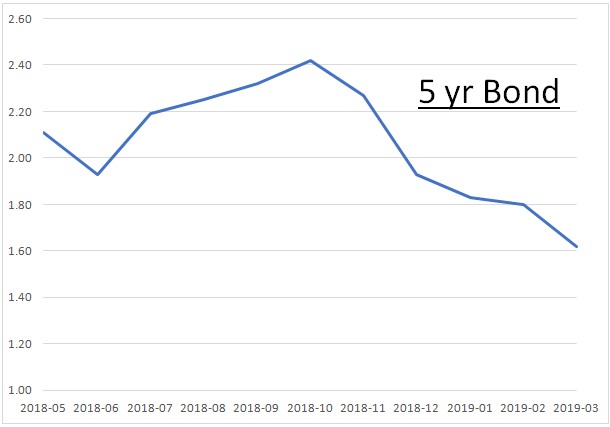

Canadian Bond Yields Have Dropped In Recent Months. Why Is This Important?

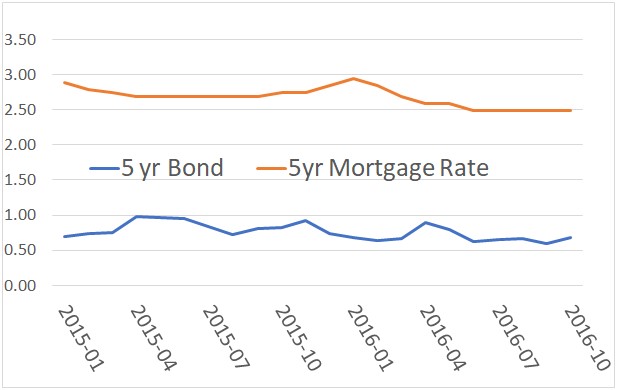

Bond yields affect mortgage interest rates because mortgages are an investment alternative to bonds. Mortgages are somewhat riskier than bonds, making mortgage rates equal to a bond yield plus a premium reflecting mortgages additional risk.

Every time bonds yield increase, mortgage rates go up. Every time bond yields go down, mortgage rates go down, but at a slower pace if compared to pace when rates going up.

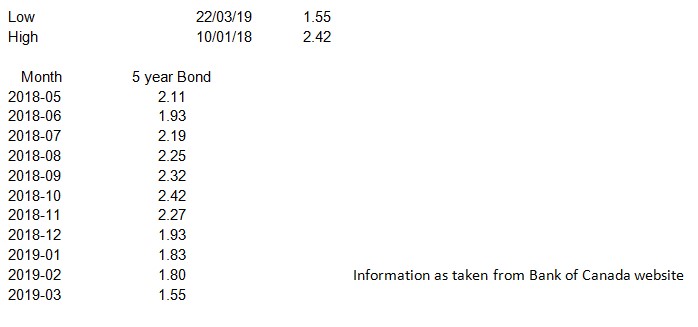

An example: In October 2018 a 5-year bond was 2.42%, and the best 5-year fixed mortgage rate was 3.89%. In March 2019 a 5-year bond is 1.55%, and the best 5-year fixed rate is 3.49%. While bond yield dropped 0.85%, mortgage rates dropped only 0.40%. These are the regular best rates, excluding various promotions. This means that fixed-rate mortgages have room to go further down, which is reflected by various unique promotions with rates at 3.20% rangeIf you choose a fixed rate mortgage today, three to six months down the line, you might find that rates are lower. It can be very frustrating and surely not efficient.

Please feel free to call or email us to discuss a few strategies to avoid this situation and still benefit from declining mortgage rates environment.

Following chart shows 5-year bond yields and 5-year mortgage ongoing best rates, excluding various unique promotions. Time period is January 2015 to October 2016; a long period of time when 5-year bond rates were below 1%